The Trump administration's implementation of tariffs, beginning in 2018, has had significant ripple effects across various industries in the United States. The dental supply industry, heavily reliant on imported products, was not immune. As dental practices strive to balance costs with quality patient care, the repercussions of these tariffs are far-reaching. This article explores the impact of these tariffs on dental supply products, how dental professionals and suppliers have adapted, and what the future may hold for the industry.

Understanding Trump-Era Tariffs

In 2018, the U.S. administration introduced tariffs on Chinese imports as part of a broader strategy to address trade imbalances and intellectual property concerns. Known as the Section 301 tariffs, they targeted a wide range of goods, including medical and dental products. The first waves of these tariffs imposed a 10% duty, later increasing to 25% on specific items. This led to immediate increases in the cost of dental supplies that are either manufactured in China or have Chinese components, affecting everything from basic instruments to high-end dental equipment.

The Effect on Dental Supply Products

1. Increased Costs for Dental Practices

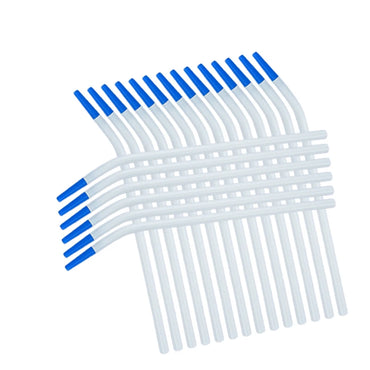

Dental practices typically operate with thin profit margins, and any increase in supply costs directly impacts their bottom line. Many of the products used daily in dental clinics—such as gloves, masks, disposable instruments, and even certain dental restorative materials—are imported or rely on components sourced from China. The 25% tariff translated into significant price hikes for these products. For example:

- Personal Protective Equipment (PPE): The tariffs coincided with the onset of the COVID-19 pandemic, exacerbating shortages and pushing up prices. The increased cost of PPE, already in high demand, became an added burden for dental practices struggling to stay open during the pandemic.

- Consumables and Restorative Materials: Items like composite resins, adhesives, and impression materials saw a price hike, affecting the overall cost of procedures such as fillings and crowns.

The price increases forced many dental practices to reconsider their budgets and, in some cases, pass on the costs to patients, potentially affecting accessibility to dental care.

2. Supply Chain Disruptions

The tariffs not only increased costs but also caused disruptions in the dental supply chain. Many dental products, particularly those involving specialized materials and components, are manufactured overseas. The imposition of tariffs caused suppliers to reassess their sourcing strategies, leading to:

- Delays in Delivery: Disruptions in manufacturing and shipping schedules resulted in longer wait times for essential dental supplies.

- Inventory Shortages: Some suppliers, anticipating tariff increases, reduced their inventory of affected products, leading to temporary shortages. For instance, dental instruments like scalers and ultrasonic tips, often manufactured in China, became harder to obtain at pre-tariff prices.

3. Impact on Small Dental Suppliers

Smaller dental supply companies were particularly affected by the tariffs. Unlike larger firms that could absorb or negotiate better rates, smaller businesses faced the brunt of the increased import costs. Many were forced to raise prices, losing competitive edge and market share. In some cases, smaller suppliers had to discontinue certain product lines entirely if the costs became unsustainable.

Strategies for Mitigating the Impact

The dental industry responded to these challenges with several adaptive strategies:

1. Diversifying Supply Chains

Dental suppliers began looking beyond China to source products. Countries like India, Vietnam, and Mexico emerged as alternative suppliers for various dental products, though transitioning to new suppliers took time and investment. While this diversification helped mitigate some of the tariff impacts, it did not completely eliminate the cost pressures since the new suppliers often had to ramp up production capabilities to meet demand.

2. Increased Domestic Manufacturing

In response to the tariff pressures, there was a renewed push for domestic manufacturing of dental supplies. While the U.S. does have a strong medical and dental manufacturing base, certain products, especially low-cost consumables, had long been outsourced due to cheaper production costs abroad. Bringing production back to the U.S. required significant investment in infrastructure and training, which many companies were initially reluctant to undertake without assurance of long-term tariff stability.

3. Cost Pass-Through to Customers

Faced with higher costs, some suppliers chose to pass these on to dental practices, which in turn had to decide whether to absorb the increased costs or pass them on to patients. Many practices opted for a combination approach, adjusting service fees slightly while seeking alternative, lower-cost supplies when possible.

4. Exploring New Product Lines

Suppliers introduced or expanded product lines from non-tariffed sources. For example, Apex Dental Supply introduced alternatives for popular items affected by tariffs, focusing on quality alternatives from non-Chinese manufacturers. This approach helped maintain product availability while mitigating the cost impact.

Long-Term Implications and Industry Shifts

1. Permanent Changes in Sourcing Strategies

The Trump-era tariffs prompted a reevaluation of global supply chains in the dental industry. Even after some tariff relaxations, many suppliers have continued to source products from diversified locations to avoid over-reliance on any single country. This shift is likely to be a long-term change, reducing the risk of future disruptions caused by geopolitical issues.

2. Potential Price Normalization

As the initial shock of the tariffs settled, some prices began to stabilize. However, the cost of switching supply chains and investing in domestic production has led to a new baseline pricing for many products. While it is unlikely that prices will return to pre-tariff levels, the industry may see a gradual normalization as suppliers adjust to new sourcing realities.

3. Ongoing Policy Uncertainty

The future of tariffs remains uncertain, with ongoing negotiations and changes in trade policies. Dental suppliers and practices must stay adaptable, monitoring policy developments closely to anticipate potential impacts. This uncertainty makes it challenging for suppliers to plan long-term pricing strategies, leading to cautious procurement practices and potentially higher inventory levels as a buffer against future price changes.

The Trump-era tariffs had a profound impact on the dental supply industry, increasing costs, disrupting supply chains, and forcing changes in sourcing strategies. Dental practices, already managing tight profit margins, felt the brunt of these changes, impacting their ability to provide cost-effective care. However, the industry has demonstrated resilience, adapting through diversification of suppliers, increased domestic production, and strategic pricing adjustments.

As we look to the future, the dental supply industry continues to navigate the complex landscape of global trade and policy. The lessons learned from the tariff era underscore the importance of flexible, diversified supply chains and proactive planning in an increasingly interconnected global market. For dental providers and suppliers alike, staying informed and adaptable will be key to managing the ongoing challenges and opportunities in this evolving landscape.

Key Takeaways:

- The Trump-era tariffs led to significant cost increases for dental supplies, impacting both practices and patients.

- Supply chain disruptions prompted a shift towards diversified sourcing and increased domestic manufacturing.

- Long-term industry changes include a more cautious approach to sourcing and a likely permanent shift in global supply strategies.

The dental industry, like many others, continues to adapt and find new ways to thrive despite external economic pressures. For dental professionals, staying informed about these market shifts is essential to maintaining efficient, cost-effective operations.